Institutions and businesses’ expanding adoption of cryptocurrency has fueled the need for seamless blockchain integration. Crypto-as-a-service solutions play a crucial role in helping companies integrate digital assets and blockchain-based functionalities into their operations, enabling efficient and secure transactions.

The cryptocurrency trading approach has changed significantly, with traders leveraging advanced tools to enhance efficiency and profitability. Unlike traditional financial markets, crypto trading operates 24/7, requiring constant monitoring to capitalize on market movements. Many investors use automated solutions like crypto trading bots to overcome manual trading limitations. These programs enable traders to execute strategies efficiently, reduce emotional decision-making, and take advantage of rapid market fluctuations. Furthermore, advancements in crypto services for trading bots have made algorithmic trading more accessible and effective.

What Is a Crypto Trading Bot?

A crypto trading bot is an automated software program that executes buy and sell orders based on predefined trading strategies. These bots analyze market data, identify trends, and place trades without human intervention, allowing traders to maximize profits while minimizing risks.

Here are some of the popular types of crypto trading bots:

- Arbitrage bots. These bots exploit price discrepancies across different exchanges. They generate profits from the price differential by purchasing an asset on one platform where it is undervalued and selling it on another where it is overvalued.

- Market-making bots. These bots place limit orders on both buy and sell sides to provide liquidity to the market while profiting from bid-ask spreads.

- Grid trading bots. By setting multiple buy and sell orders at predefined price levels, these bots generate profits from market fluctuations within a set range.

- Trend trading bots. These bots analyze market trends and execute trades toward an ongoing trend, aiming to capitalize on upward or downward price movements.

- Mean reversion bots. These operate on the assumption that asset prices will revert to their historical average over time, executing trades when an asset is overbought or oversold.

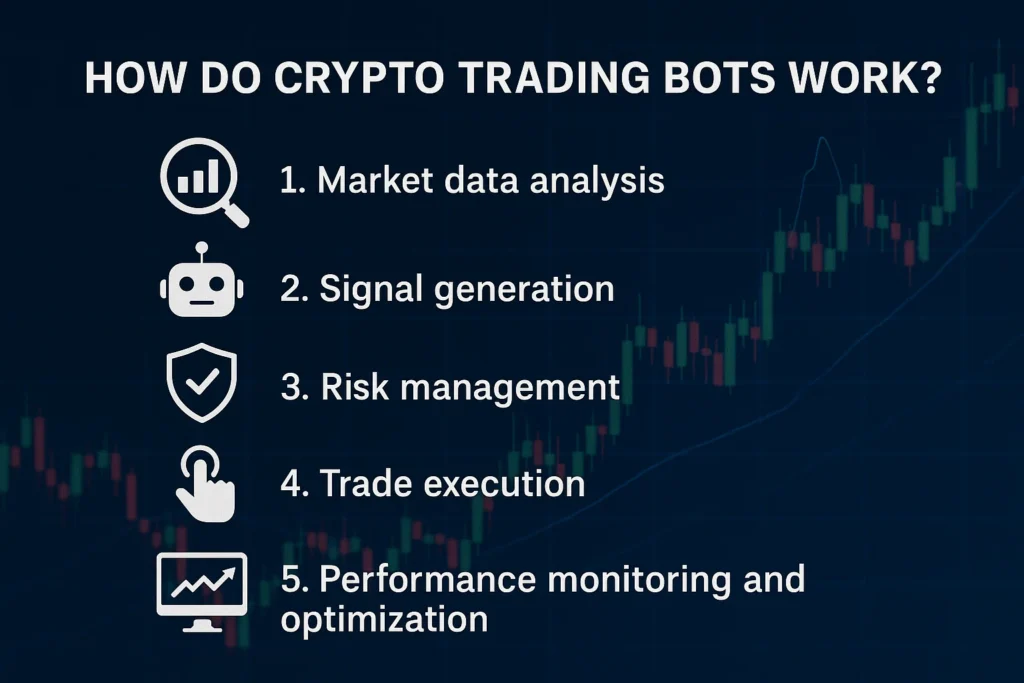

How Do Crypto Trading Bots Work?

Crypto trading bots function through data analysis, signal generation, and order execution. Here’s a breakdown of their operational process:

- Market data analysis. The bot gathers historical and real-time market data, including price movements, trading volume, and order book depth. Advanced bots utilize machine learning algorithms to detect patterns and predict future trends.

- Signal generation. Using predefined algorithms or machine learning models, the bot identifies potential trading opportunities based on technical indicators such as moving averages, RSI, MACD, and Bollinger Bands.

- Risk management. Bots incorporate risk management strategies, such as stop-loss and take-profit levels, to reduce potential losses and maximize gains.

- Trade execution. Once a trading opportunity is identified, the bot places buy or sell orders on the exchange via an API, ensuring rapid execution to capitalize on market fluctuations.

- Performance monitoring and optimization. Many bots include analytics tools that track performance, allowing users to optimize their trading strategies over time.

How to Use a Trading Bot?

Setting up and using a crypto trading bot requires careful planning and execution. Here’s a step-by-step guide:

- Choose a suitable trading bot. Select a bot that aligns with your trading strategy and technical expertise. Popular choices include open-source bots, cloud-based bots, and proprietary algorithmic solutions.

- Select a compatible exchange. Ensure the bot supports your preferred exchange and integrates seamlessly through API access.

- Configure the trading strategy. Define trading parameters such as asset pairs, order types, position sizing, and risk management settings.

- Backtest the strategy. Before deploying the bot in a live environment, run historical backtesting to assess its performance and make necessary adjustments.

- Deploy in a live market. After satisfactory backtesting, enable the bot in a live market with a controlled capital allocation.

- Monitor and optimize. Review the bot’s performance regularly and fine-tune its parameters to adapt to changing market conditions.

Monitoring bot operations is crucial, as fully relying on automation can pose significant risks. While bots excel at executing predefined strategies, they cannot account for unexpected market anomalies, security threats, or exchange downtimes. Without human oversight, a bot may continue executing trades in unfavorable conditions, leading to substantial financial losses. Active monitoring ensures timely intervention, enabling traders to adjust strategies, halt operations if necessary, and safeguard capital from unforeseen disruptions.

Top 5 Crypto Trading Bots in 2025

To help traders automate their strategies effectively, here are five of the most popular and trusted crypto trading bots in 2025:

- 3Commas

Known for its user-friendly interface and smart trading terminal, 3Commas offers portfolio management, copy trading, and automated bots for various strategies like DCA and Grid. - Cryptohopper

This cloud-based bot supports multiple exchanges and provides advanced tools such as backtesting, trailing stops, and technical analysis indicators, ideal for beginners and pros. - Pionex

It is one of the few exchanges with free built-in bots. Pionex supports Grid, DCA, and Arbitrage bots with low trading fees and a mobile-friendly interface. - Bitsgap

An all-in-one trading platform offering smart bots, portfolio tracking, and arbitrage features. Its AI-driven grid bot is highly praised for profitability and ease of setup. - Gunbot

A veteran in the space, Gunbot is a highly customizable bot for tech-savvy users who want full control over their strategies. It supports over 100 indicators and multiple exchanges.

Crypto Solutions for Services with Trading Bots

To maximize the efficiency of crypto trading bots, traders rely on a range of crypto services for algorithmic trading. These solutions enhance execution speed, security, and analytical capabilities, ensuring optimal performance. Here are some crucial solutions for traders who use bots:

- API access. Reliable and low-latency API access is crucial for bot functionality. Exchanges that provide robust APIs enable bots to execute trades instantly and fetch real-time market data without delays.

- Colocation services. Institutional traders and high-frequency trading firms utilize colocation services to minimize latency. By placing trading servers near exchange data centers, bots gain a competitive edge in execution speed.

- Advanced order types. Platforms that support advanced order types, such as iceberg orders, trailing stop-loss, and TWAP (Time-Weighted Average Price), provide traders with more control over bot-driven trades, allowing for more nuanced and potentially profitable bot-driven trades while reducing risks associated with large order execution.

- High-frequency trading (HFT) support. HFT bots require specialized infrastructure, including ultra-low-latency execution, direct market access (DMA), and proprietary algorithms. Exchanges that cater to HFT firms offer solutions to optimize speed and efficiency.

- Testing environments. Simulated trading environments allow traders to test strategies in real-time market conditions without risking capital. These environments help refine algorithmic strategies before deployment.

- Data analysis and machine learning. Advanced bots use AI-driven data analysis to predict market trends. Platforms that provide historical and real-time data feeds allow traders to optimize their strategies using machine learning models.

- Security measures. Given the risks associated with automation, robust security mechanisms, such as two-factor authentication (2FA), encrypted API keys, and withdrawal whitelists, are essential to protect trading accounts from unauthorized access. Notable security breaches, such as exchange hacks and API key leaks, have led to significant financial losses, underscoring the need for stringent security protocols.

How Digitalogy Can Help You Build a Custom Crypto Trading Bot

Suppose you want to build a custom crypto trading bot tailored to your unique strategy. In that case, Digitalogy.co can connect you with top-tier developers specializing in blockchain, algorithmic trading, and AI. Whether you need a basic grid bot, a complex machine learning-based prediction system, or integration with multiple exchanges, Digitalogy’s network of pre-vetted professionals can deliver your solution securely and efficiently. With zero recruiting fees and a 2-week risk-free trial, it’s an ideal way to build robust, personalized bots that give you an edge in the fast-paced crypto markets.

Crypto trading bots have revolutionized the way traders interact with digital asset markets. By automating trading strategies, these bots improve efficiency, reduce emotional biases, and capitalize on market opportunities 24/7.